Banks Deposit $35billion "Uninsured" In Frc As Show Of Confidence, Cs Gets Backing Of Swiss National

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

A Historic Show of Faith

Greetings, my fellow enthusiasts of the financial frontier! It's 4:25 in the afternoon, and I couldn't wait to share with you a remarkable turn of events in the world of banking. Now, I know it's a tad early for market closings, but I have a delightful grandson's show to attend this evening, so we're diving into this exciting update ahead of time. Besides, the real action has already unfolded, and the headlines are ablaze with the news.

First Republic, one of the leading banks, is about to receive a hefty cash infusion. But here's the twist - it's not your usual investment. It's a play straight from the pages of history, a page out of JP Morgan's playbook during the tumultuous Panic of 1907. Picture this: JP Morgan gathered all the warring factions of the financial world into a room, turned the key, and declared, "No one leaves until we have a deal!" And lo and behold, a deal emerged.

Fast forward to today, and it's like déjà vu. All the big players, presumably on a virtual Zoom meeting, have decided to join hands and make deposits ranging from two to five billion dollars, totaling a whopping 35 billion. It's a colossal show of faith in First Republic. This morning, the stock dipped as low as $19.80, and after the news broke, it skyrocketed to $40. As of now, it's trading at $29.84, down by a mere 1.32.

You might be wondering, what's the catch? Well, these are uninsured deposits, a gamble of trust undertaken by the likes of JP Morgan, Wells Fargo, and Goldman Sachs. It's a financial theatrics at its best, my friends, and it's unfolding right before our eyes.

The S&P Spectacle

Now, shifting gears to the thrilling world of trading, we had quite the spectacle today. We snagged an absolute gem of a trade in the S&P, purchasing options that expire tomorrow at a strike price of 392. At the time of purchase, the index was hovering around 386-387, and we grabbed these beauties for a mere 76 cents each. That's pocket change compared to the thrill ride we embarked upon.

We sold one option for 318 and the other for 361, resulting in a profit of a staggering 140 odd percent. Double that in our large account, and you've got yourself a trade worth reminiscing about over a glass of your finest champagne.

FedEx Takes Flight

Post-market closure, FedEx, the parcel giant, had a reveal of its own. It missed the mark on revenues but soared past expectations in earnings. The stock, which had been playing a teasing game lately, closed at $204.05, a gain of 8.75 or 4.5 percent. But that was merely the opening act. Post-market, it ascended to a high of $223.50 and was last seen at $219.56, a marvelous increase of 12.4 percent.

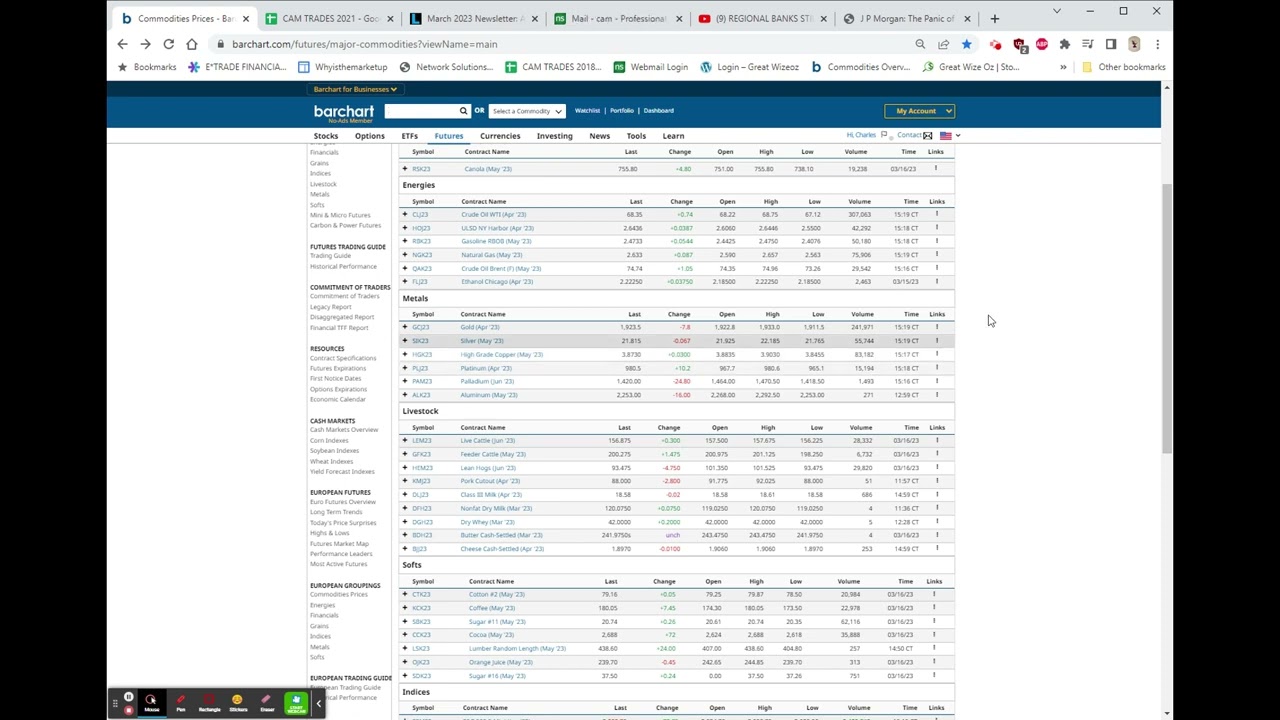

A Glimpse into the Commodity Universe

Now, let's venture into the alluring world of commodities. Oil gave us a modest nudge higher, nothing to write home about. We danced at $65.65 yesterday, flirted at $68.75 today, and finally settled at $68.35. Gasoline mirrored the dance moves, edging up by eight and a half cents. Heating oil and gasoline joined the party, following a melodious rhythm.

Gold, however, chose to be the lone wolf, down by 7.80. Silver, the silver screen sensation, slid down by 6.70. Copper, the industrial heartthrob, gained some weight, and Platinum danced up by 10.2. In the soft commodity realm, cotton saw a glimmer of hope, up by a nickel, while coffee, a true underdog, rallied fiercely, marking a 7.45-point gain. Our Jo position took a hit, and we bid farewell to the second half, having sold it at a not-too-shabby price of 194.

Sugar, the sweet darling of commodities, decided to steal the spotlight, up by a whopping 26 cents. Cocoa and lumber joined the rally, reaching for the stars. Lumber's performance was so stellar that it closed at the limit on the high of the day. The housing starts report was a pleasant surprise, and it seems lumber had an exclusive invitation to the celebration.

The S&P's Joyous Rally

As the day ended, the S&P futures were up by 68, and they continue to surge higher as we speak, gaining 74. The NASDAQ sprinted ahead by 340 points, and the Dow danced to a 415-point tune. The Russell, our steadfast little warrior, chugged along, unfazed, with a gain of 27.30.

As for our friendly dollar, it took a slight dip. In the world of cryptocurrencies, Bitcoin and Ethereum had their heads held high, while the bonds decided to march to a different tune, trending downward.

Before I bid adieu, here's a quick recap: initial claims were 192, a drop from 205, and continuing claims stood at 1.684 million, down from 1.720 million. Housing starts showed resilience, with a million 450 against a million 340. Permits, too, were on the upswing, and import prices took a dip. Export prices inched up, ever so slightly.

And with that, I'll leave you to ponder this rollercoaster ride of a day. I'll be back first thing in the morning as we embark on another exhilarating journey through the wild financial terrain. Until then, have a splendid evening, my fellow financial thrill-seekers!

Related Recaps

- ONE Championship Fight Night 8 | LIVE Fight Companion | | SCMP Martial Arts

- Dog prepares body to sustain energy & produce nutritious milk for her puppies.

- Nintendo Downgraded Tears of the Kingdom For Everyone!

- The Rough-Face Girl | Children's Book Read Aloud

- Why you SHOULDN'T plug into public USB ports...