Fed Will Probably Pause On Monetary Tightening: Woods

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

In the world of finance, one thing that is certain is the uncertainty surrounding rate hikes. We often find ourselves speculating on when they will happen and how they will affect the economy. However, what is even more intriguing is the lack of evidence to support the transmission of rate hikes. It's like trying to catch a glimpse of a mythical creature - you hear stories, but you never actually see it.

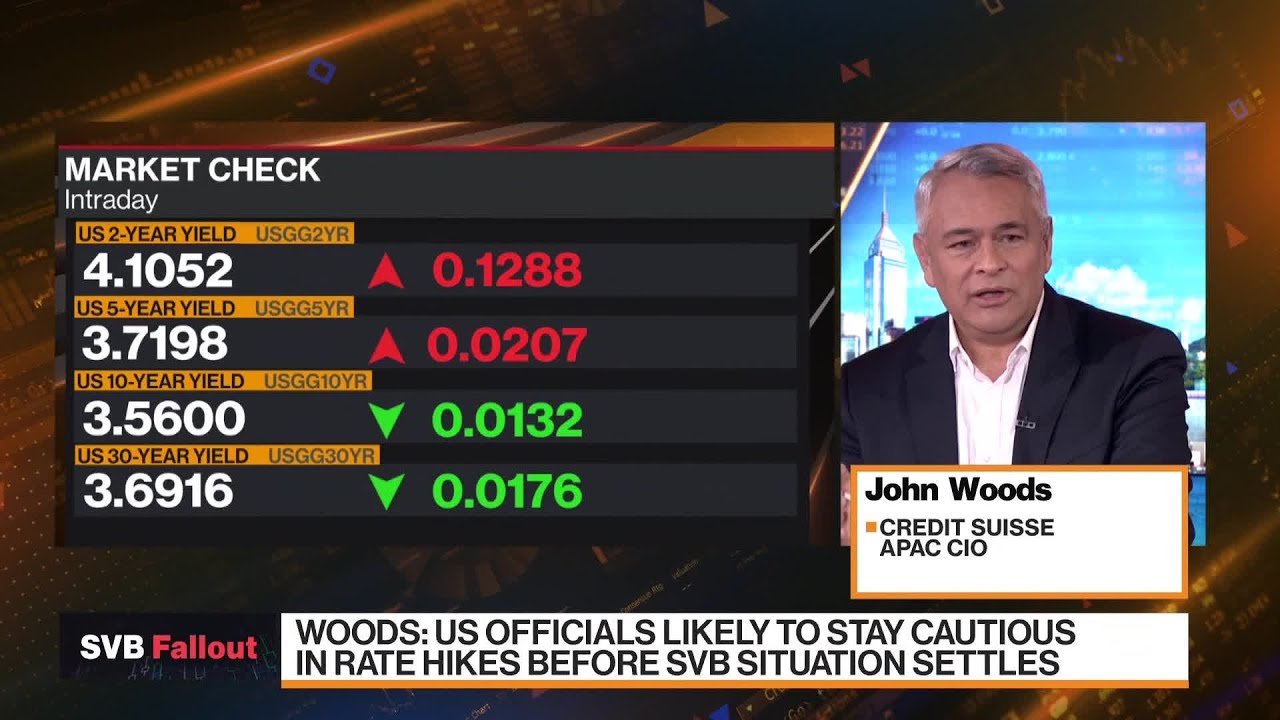

Just when we thought we had it all figured out, rate hikes came out of left field once again. But this time, they made their presence known in the banking system. And as we all know, the banking system has a significant impact on the overall economy. So, how does the Federal Reserve view this sudden turn of events? Do they simply brush it off as business as usual or do they take a closer look?

An Odd Disconnect

As an observer, I must say that the recent rate hike was slightly odd, if not bizarre. Over the course of 14 months, we witnessed a staggering seven or eight rate hikes, yet the real economy seemed to show little reaction. It was as if there was a disconnect between the tight monetary policy and its impact on the everyday lives of people. But now, that disconnect seems to be a thing of the past.

The so-called monetary lag, the time it takes for a tightening policy to have an effect on interest rates, has substantially reduced. This reduction in lag time is like a catalyst, igniting a chain reaction in the Silicon Valley Bank and beyond. The real impact of interest rates is finally being felt, and it's causing the Federal Reserve and the financial markets to tread cautiously.

Walking on Eggshells

In the wake of these developments, the Federal Reserve and the financial markets find themselves walking on eggshells. They are acutely aware of the need to understand the potential impact on the broader market. The question of liquidity risk looms large, and depositors crave confidence and stability.

As a result, it is highly likely that the Federal Reserve will hit the pause button. This pause in monetary tightening will instill greater confidence in depositors and help alleviate the risk of a run on smaller and medium-sized banks. It's a delicate balancing act, but a necessary one to ensure the stability of the banking system.

The End of an Era?

Looking ahead, one can't help but wonder if we are on the cusp of a high-risk rally. Could this be the end of the relentless rate hikes and the beginning of easier monetary conditions? Only time will tell. For now, I find myself leaning towards the pause camp.

Of course, when significant events like this occur, regulators and financial institutions must not forget the importance of stress tests. While the Silicon Valley Bank may not be subject to the same stress tests as the Federal Reserve, it is crucial for regulators to tighten their oversight and ensure the safety of lenders and borrowers alike. Tighter credit conditions may be on the horizon, affecting borrowers in a substantial way.

In the end, it seems that liquidity issues are at the heart of this matter, with potential spillover into solvency risks. The movement from the bank book to the trading book may have caused some mark-to-market losses for the Silicon Valley Bank, but the ripple effects extend beyond its walls. The tightening of lending practices and the anticipation of economic deceleration are evident in the market's pricing.

As we navigate through these uncertain times, one thing is clear - the world of finance is full of surprises. From rate hikes that come out of nowhere to the impact they have on the banking system, it's a constant dance between stability and risk. So, let's buckle up and prepare for whatever twists and turns lie ahead in this ever-changing financial landscape.