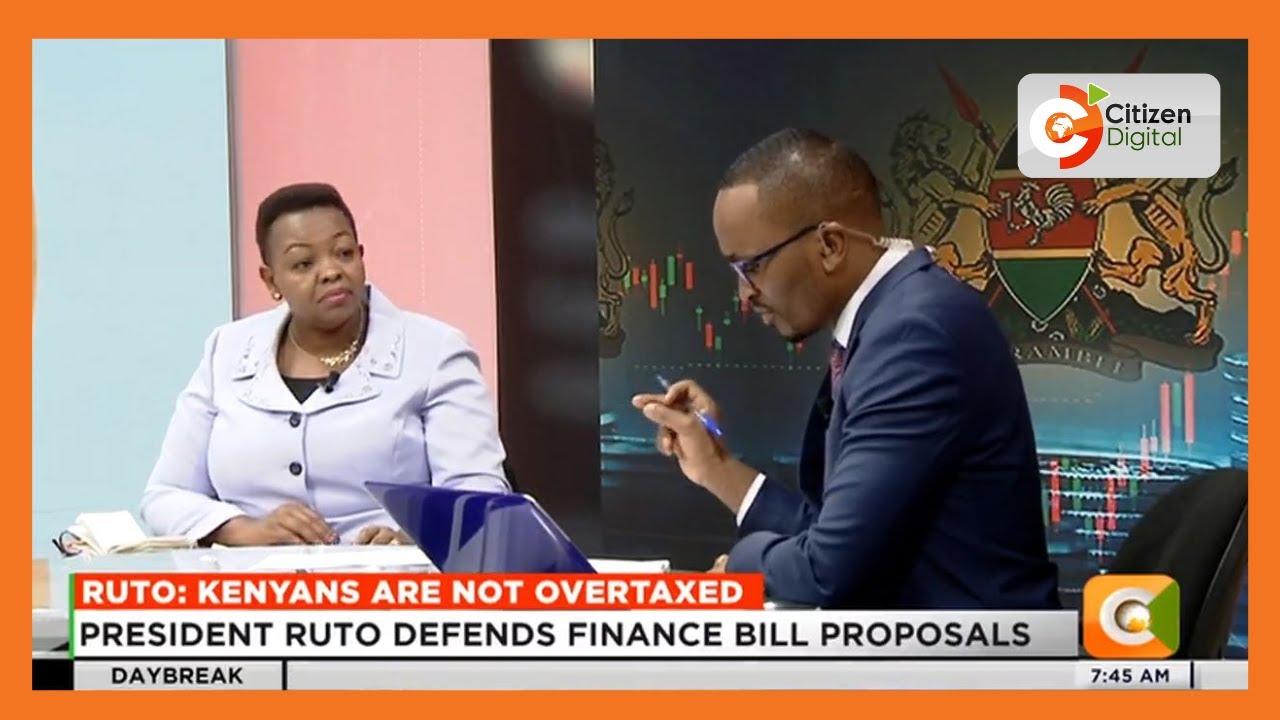

Sam Gituku Puts Senator Veronica Maina To Task On Why The Housing Levy Will Be Double Taxed

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

The issue of the housing levy in Kenya has sparked a heated debate among citizens. In one corner, you have the government arguing for the levy, citing Section 26 of the ACT, which states that contributions paid out in cash shall be included in the contributor's taxable income for the year and be subjected to tax at the prevailing rates. On the other side, you have citizens questioning the fairness of the levy, particularly in relation to double taxation.

Understanding the Housing Levy

Before we dive into the debate, let's first clarify what the housing levy is all about. This levy is a three percent contribution deducted from employees' salaries, aimed at providing affordable housing for Kenyan citizens. The rationale behind it is to enable individuals to upgrade their living conditions and move from low-income areas to more comfortable ones. It's meant to be a savings scheme, helping individuals gradually build up funds for future housing needs.

The Issue of Double Taxation

Critics of the housing levy argue that it is effectively double taxation. They point out that employees' salaries are already subjected to various deductions, such as NHIF (National Hospital Insurance Fund) and NSSF (National Social Security Fund). Adding the housing levy on top of these deductions seems unfair and burdensome.

The concern arises from the fact that the housing levy is deducted from the employee's salary after tax has already been applied. Since this contribution is considered taxable income, it means that individuals are essentially paying tax on an amount that has already been taxed once. This idea of double taxation raises serious questions about the fairness and practicality of the housing levy.

The Need for Open Dialogue

While the government argues that the housing levy is a necessary step towards providing affordable housing for all Kenyans, citizens have every right to question the taxation policies surrounding it. It is essential to have an open dialogue and discussion regarding whether it is reasonable to tax a contribution that has already been subjected to tax once.

One possible solution is for the legislators to exempt the housing levy from taxation if it has already been taxed as part of the individual's income. This would alleviate the concerns of individuals who feel that they are being unfairly burdened with double taxation. By initiating a proper conversation and debate, Kenyans can seek a fair and equitable solution to this issue.

Looking Ahead

The housing levy debate highlights the need for transparency and clarity when it comes to taxation policies. It is crucial for the government to ensure that citizens understand the purpose and implications of any levy imposed on their income. Clear communication and education can help dispel misconceptions and build trust between the government and the people.

Furthermore, it is important to explore alternative ways of funding affordable housing initiatives. The burden of providing affordable housing should not solely be placed on the shoulders of the working class. Governments should explore partnerships with private entities and leverage innovative financing mechanisms to ensure the availability of quality housing for all citizens.

In conclusion, the housing levy debate in Kenya raises valid concerns about double taxation. While the goal of providing affordable housing is admirable, citizens have the right to question the fairness of taxing a contribution that has already been subjected to tax once. Open dialogue and a willingness to consider alternative solutions are essential to reach a resolution that benefits all Kenyans.

Related Recaps

- Tiệm Bánh Tuổi Thơ Bất Ổn P139 #comtuoitho #shorts

- Devotion to the Sacred Heart (28 Apr)

- GE Level 5: What You Need To Know | Forge of Empires

- Scituate BEST american restaurants | Food tour of Scituate, Massachusetts

- Buster Murdaugh's girlfriend, Brooklynn White, also called into the sheriff's office to report