Is The Stock Market Today Overpriced?

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

Equities, oh equities. They're in a strange spot, my friends. The consensus out there is that they're overpriced, that we're due for a market correction. And you know what? That may be correct. But here's the thing, when the consensus is so overwhelmingly in one direction, it makes me a little uneasy.

Now, I've been around the markets for quite some time, and let me tell you, whenever everyone is pointing in one direction, well, usually it goes the other way. It's like a game of musical chairs, and right now, everyone is scrambling to find a seat. But what if I told you that the October lows are not the lows of this particular bear market?

I see weakness in the economy, my friends. It's not just about the jobs numbers, although those have taken a bit of a hit lately. It's about consumer spending, about the savings rate. We're seeing a downturn in consumer spending, and the savings rate? Well, that's falling too. People are dipping into their savings, and that's never a good sign.

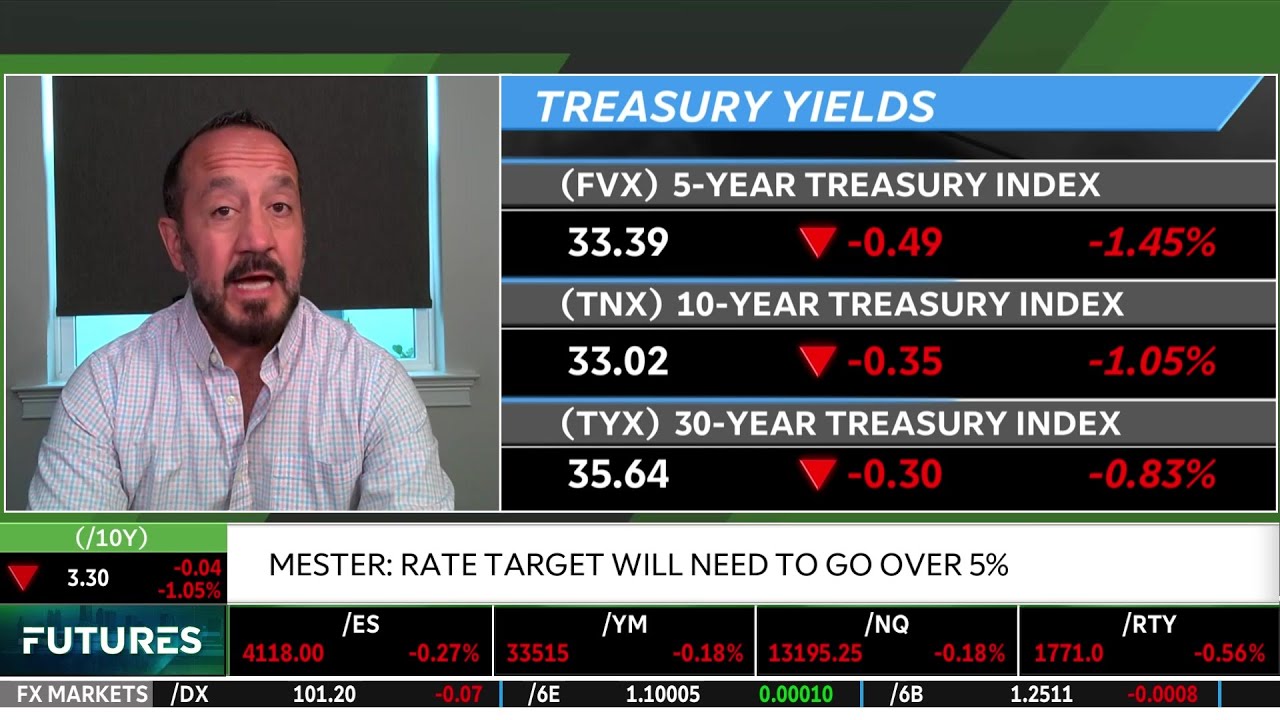

Combine that with the higher rates and the resolve of the Fed to keep those rates high, and you've got a recipe for potential trouble. The market is pricing in rate cuts, but I have a feeling the Fed is going to keep rates where they are. And let me tell you, that doesn't bode well for profits in the upcoming earnings season.

The Reckoning

Now, I don't want to be too dramatic here, but I think there's a reckoning coming. And it's likely that the stock market has it wrong. You see, the Fed is in a tough spot. They only have one tool in their toolbox, and that's interest rates. And if they don't use that tool, they're going to be accused of letting inflation run wild. But here's the thing, in order to fight inflation, you need a slowing economy. You need job losses. And we haven't even started to see that yet.

So, my friends, we may be heading into a period of stagflation. And historically, that's not a great time for stocks. In fact, it's the only period of time in history where stocks don't perform well. But here's the thing, I don't see it as a disaster for investors. No, I see it as a buying opportunity. A really good one, in fact.

You see, stocks can go up in a recession. They can act like gold, like assets that rise with inflation. And that's what we're seeing here. So while everyone else is panicking, I'm seeing an opportunity. But let me be clear, I don't think the buying opportunity was in October. No, my friends, we're just getting started.

The Fed and the Treasury

Ah, the Fed and the Treasury. Two players in this grand game of economics. They both have their tools, their strategies. And let me tell you, they don't always see eye to eye.

The Fed, with its hammer, is focused on fighting inflation. They're keeping rates high, even as the market is begging for cuts. And the Treasury? Well, they're pushing down, hoping that a slowing economy will cure inflation. It's a delicate dance, my friends, and I'm not sure who's got it wrong here.

But here's the thing, the Fed only has one tool. And if they don't use it, they'll be accused of doing nothing. So we're stuck in this situation, where we need a slowing economy to fight inflation, but we also need job losses to get people to pull back on their spending. It's a tricky balance, and I'm not sure how it's all going to play out.

The Rise of Bitcoin

Ah, Bitcoin. The darling of the digital currency world. It's been quite a ride for this little coin, my friends. Up 70% so far this year. And you know what? Investors are starting to see it as a safe haven. A little slice of security in these uncertain times.

But here's the thing, there's a new player in town. Central bank digital currency. Now, most people believe it's centralized, controlled by the banks. But if you believe in digital currencies, my friends, I urge you to support Bitcoin. It's decentralized, it's independent. And yes, I've bought back into Bitcoin. I'm hanging on to this position, because I believe in what it's doing.

Now, I'm not sure if Bitcoin is investable yet. There's still a lot of volatility, a lot of unknowns. But I see potential. I see a trade worth making. And in these uncertain times, sometimes you have to take a chance.

Conclusion

So there you have it, my friends. Equities are in a strange spot, but that doesn't mean there isn't opportunity. We may be heading into a period of stagflation, but that's not necessarily a bad thing for investors. And while the Fed and the Treasury dance their dance, we have to keep an eye on Bitcoin. It may just be the future of currency.

So buckle up, my friends. The ride may be bumpy, but it's also full of potential. And remember, when everyone is pointing in one direction, it's usually a good idea to look the other way.

Related Recaps

- Успешный, отзывчивый, сильный и щедрый Рэй ищет подругу с семейными ценностями и добрым сердцем

- "ISSO É UM ABSURDO!" Atitude INACEITÁVEL em jogo do Flamengo na Libertadores é CRITICADA!

- இளையராஜா யுவன் சேர்ந்து போட்ட BGM theatre-ரே அதிரும் Naga Chaitanya

- Yes Boss (යර්ස් බොස්) | Episode 240 | Sirasa TV

- Easy Ways to Save Food Fresh For Longer