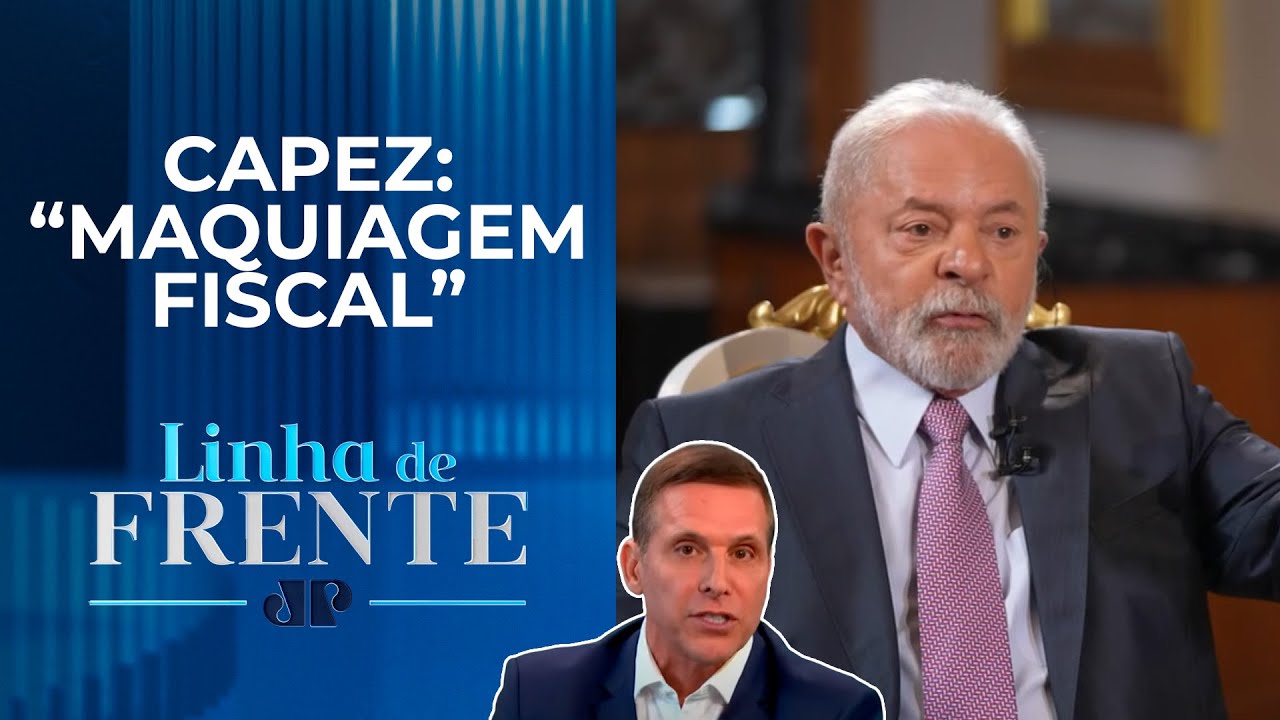

Oposição Quer Punição A Lula No Arcabouço I Linha De Frente

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

The stage is set, the players are in position, and the tango of fiscal responsibility begins. In the grand theater of Brazil's political landscape, Cláudio Cajado, the PT representative from Bahia, holds the pivotal role as the fiscal framework's narrator. But like any compelling drama, there's an ongoing tug of war. The opposition to President Lula's government presses him to enact penalties for failing to meet fiscal targets. They argue it's a matter of upholding the law of fiscal responsibility. It's as obvious as an object dropping when released – the law of gravity. Yet, the script's conclusion is still up in the air, with Cláudio Cajado suggesting that the final act may be delayed by yet another week. And he accompanies this announcement with the assurance that he won't include what he calls "draconian measures" in case of fiscal target non-compliance. But the question lingers, can we have faith in this fiscal framework? Is it a script worth believing?

The Fiscal Framework: A Complex Overture

In my humble opinion, the fiscal framework is akin to a complex musical score, decipherable only to a small fraction of economists. Its purpose seems less about ensuring the government's adherence to spending limits and more about creating an intricate roadmap to circumvent budget constraints. This fiscal framework is the response Finance Minister Fernando Haddad must provide to the society without undermining the government's spendthrift ways. They're ready to splurge – 9 billion in parliamentary amendments, 170 billion in exceeding the expenditure cap. The constitutional spending cap rule seems simple enough: what you spend this year is the maximum for the next, adjusted for inflation. But when you introduce a labyrinth of rules that practically says, "The government can spend, but let's mask it," the result is a fiscal sleight of hand.

The financial market embraces this fiscal framework, but it's met with skepticism and concerns about fiscal imbalances. Overspending, outstripping revenues, it's a recipe for printing money, devaluing the currency, and triggering inflation. Here's an interesting tidbit: the United States, the world's wealthiest nation, with a GDP of trillions of dollars, will, on June 1st, declare they can't pay their bills – a deficit of 33 trillion reais, nearly 30 times Brazil's GDP. It's a situation that calls for serious contemplation. And amidst this, there are voices still willing to lend to Argentina – kudos to their optimism.

The "New Poor" and the Debt Conundrum

Let's talk numbers. A staggering 43.4% of Brazilian families are in debt. That's less than half the population, as an average family has 4.3 members. To bail out this considerable chunk of the population, which struggles to make ends meet, the government would need 5 billion reais – just half of parliamentary amendments. But if we consider that Brazilian families average three members, the number drops to 30. So, today, I'm addressing 1.5 million families. It's as if they want the people to fend for themselves. And yet, some still believe the president is the champion of the poor. The reality is starkly different.

Frequently, there's a clamor for a reduction in interest rates. But the President of the Central Bank can't bear the burden alone. Lowering interest rates should come with concrete assurances of fiscal responsibility. It's about ensuring a secure fiscal policy in the country to avoid further indebtedness. However, with the attempt to evade accountability for fiscal violations, it raises questions about what the Central Bank can do. After all, if the spending cap is removed, the signal changes, and there's no guarantee that the President will adhere to fiscal responsibility. The result? He steps into the public eye and demands a reduction in interest rates, blaming the Central Bank for a situation he, in part, contributed to.

The Challenging Duet of Fiscal Responsibility and Spending

This issue brings into focus the government's struggle to balance the books. In 2017, the first year of the spending cap rule, interest rates naturally dropped to 8%. The market understood that the government's reduced expenditure would allow for lower interest rates. However, when you desire to breach spending limits, engage in reckless spending, and disregard inflation concerns while also requesting interest rate reductions, it's akin to a family that decides to "live life to the fullest" for a month, spending recklessly, without any fiscal restraint.

In conclusion, as Brazil's fiscal tango unfolds, it's essential to balance the rhythm of fiscal responsibility with the melodies of spending. A clear, accountable framework must be in place to ensure that the nation's financial dance remains harmonious. Without it, the economic stage might see more than just a few missteps, and the repercussions could be felt far and wide. The Brazilian people deserve more than a performance; they deserve a responsible and forward-thinking fiscal script that truly cares for their well-being. The government's role is to conduct this orchestra of finances, playing a symphony that benefits all. Let's hope the crescendo leads to prosperity, not chaos.

Related Recaps

- Reair: The Preacher’s World #1..!

- 🔴 Ao Vivo - Day Trade - Indice - Dolar - 26/04/2023 - LIVE 🔴

- All BO2 ZOMBIES EASTER EGGS REVERSE!! [Speedrun!] (MAXIS) (Call of Duty: Black Ops 2 Zombies)

- 7 Conditions for Answered Prayers ( PRAYERS THAT GET ANSWERED )

- Gia đình mình vui bất thình lình tập 5 | Hà và Trâm Anh giảng hòa, vui vẻ làm chị em dâu