Bofa's Michael Gapen Expects A 'Dovish 25 Bps Hike' And Maintained Balance Sheet Runoff

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

In the world of finance and economics, decisions are made, forecasts are analyzed, and strategies are devised. The central bank, often a silent but critical player in this grand theater, finds itself at a crossroads. It's not about the "what" they will do, but the profound "why" that justifies their actions. Let's delve into this intriguing financial tango where the central bank must balance two crucial goals with two mighty tools.

Balancing Act: Financial Stability and Price Stability

Imagine for a moment that you're juggling not just one, but two goals. The central bank is in precisely that predicament. On one hand, they aim for financial stability in the short run. This means keeping the financial ship steady, preventing abrupt market shocks, and ensuring economic waters are navigable.

On the other hand, they're also striving for price stability in the medium term. This involves keeping inflation in check, so the cost of goods and services doesn't wildly swing, avoiding financial chaos.

The fascinating part is that the central bank doesn't just sit and watch; it wields two formidable tools in this act. They have the "lender of last resort" function, which acts as a financial safety net to prevent crises. Additionally, they have the policy rate, which they can adjust to influence inflation and economic activity.

In essence, the central bank must deftly execute this financial tightrope walk, maneuvering between these two goals and utilizing these tools effectively.

The Hawkish Dilemma and the Dovish Response

Now, if you're thinking that the central bank's actions are predictable and straightforward, you might want to think again. The central bank's moves aren't set in stone. While many expect a 25-basis point rate hike this week, the message might be more "dovish" than you'd anticipate. What's "dovish," you ask? Well, it's about embracing uncertainty, moving cautiously, and being less aggressive.

Why the sudden shift in tone? It all boils down to the uncertainty that has reared its head. The financial markets are becoming more influential than ever. In a sense, it's like a financial domino effect. If the central bank takes a "hawkish" approach, it could potentially ruffle the financial markets. On the flip side, opting for a more cautious, "dovish" stance acknowledges the reality of data-dependent decisions, which now include the influence of the financial markets.

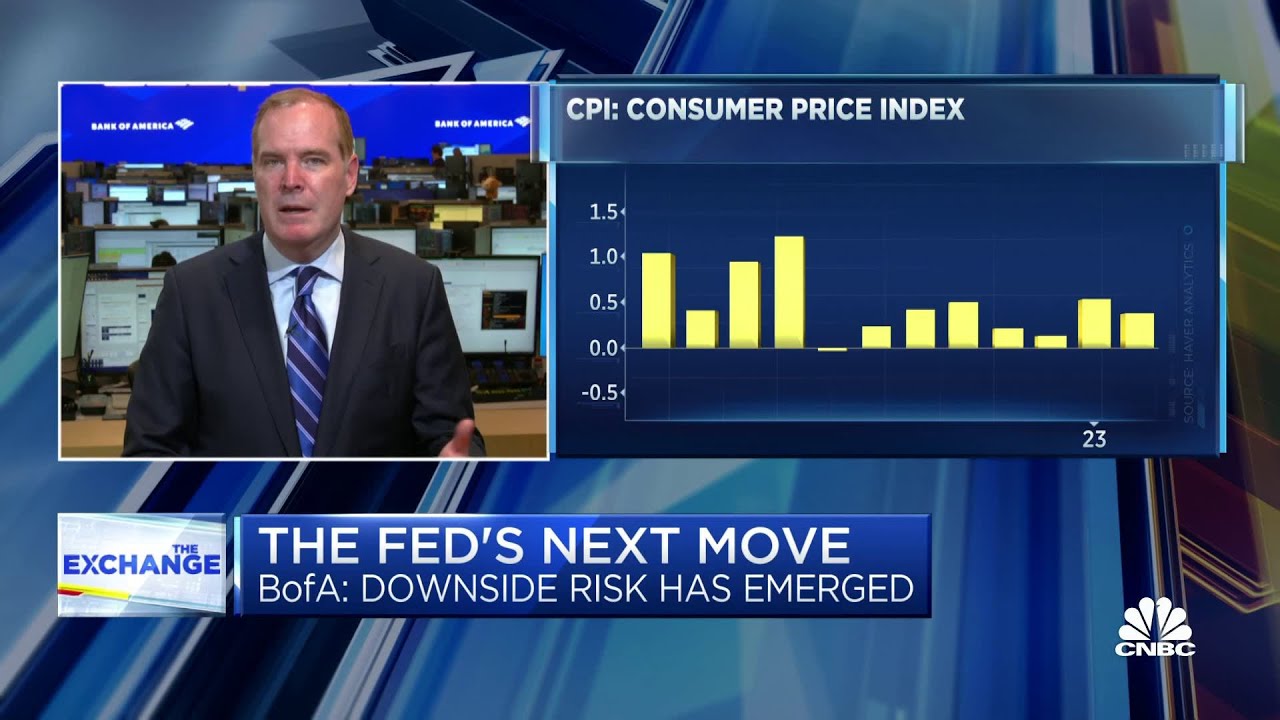

The Emergence of Downside Risk

For the longest time, the economic momentum has been akin to a speeding train on an open track. Sure, there were occasional slowdowns in sectors like housing and business spending, but nothing too alarming. The labor market remained strong, and consumer spending kept the economic engine humming.

However, there's a twist in the plot. For the first time, downside risks are raising their heads. It's like a storm cloud gathering on the horizon. The baseline prediction was a recession, but the economy's momentum could previously shrug off these concerns.

What's different now? The landscape is shifting. Lending standards in banks are tightening, and credit growth is slowing. If this trend continues, it's a potential recipe for a more significant economic downturn. This is what we mean by "downside risk emerging."

The Timing of Actions: To Cut or Not to Cut

So, with these newfound uncertainties and emerging downside risks, you might wonder why the central bank doesn't hit the brakes or even pause. Well, it's all about their grand plan to bring inflation down to 2%. To achieve this, they might need to correct some imbalances in the labor market, and that might look like a traditional recession.

History is their guide, and it suggests that when the central bank strives for price stability, it often involves labor market corrections that resemble a recession.

Now, with the balance of risks shifting, and the potential for a more pronounced economic contraction, the transition from rate hikes to cuts may indeed come sooner. However, it's not a certainty etched in stone; it's another chapter in this intricate financial tale.

As the central bank navigates the economic storm, they must weigh their dual goals, calibrate their tools, and dance to the tunes of financial uncertainty. The financial markets watch with bated breath, for every move they make can ripple through the world's economies. It's a fascinating spectacle, where financial stability and price stability converge, and where the "why" of their actions shapes our economic destiny.

Related Recaps

- CHAMPIONS! Liverpool's Premier League trophy lift

- [EPISODE] 지민 (Jimin) ‘Set Me Free Pt.2’ MV Shoot Sketch - BTS (방탄소년단) - REACTION

- Parts of Karachi receive rain with strong winds

- UFC Fight Night 224 Full Fight Card Faceoffs From Las Vegas

- First look at RODE’s RodeCaster Duo and RodeCaster Pro II firmware updates