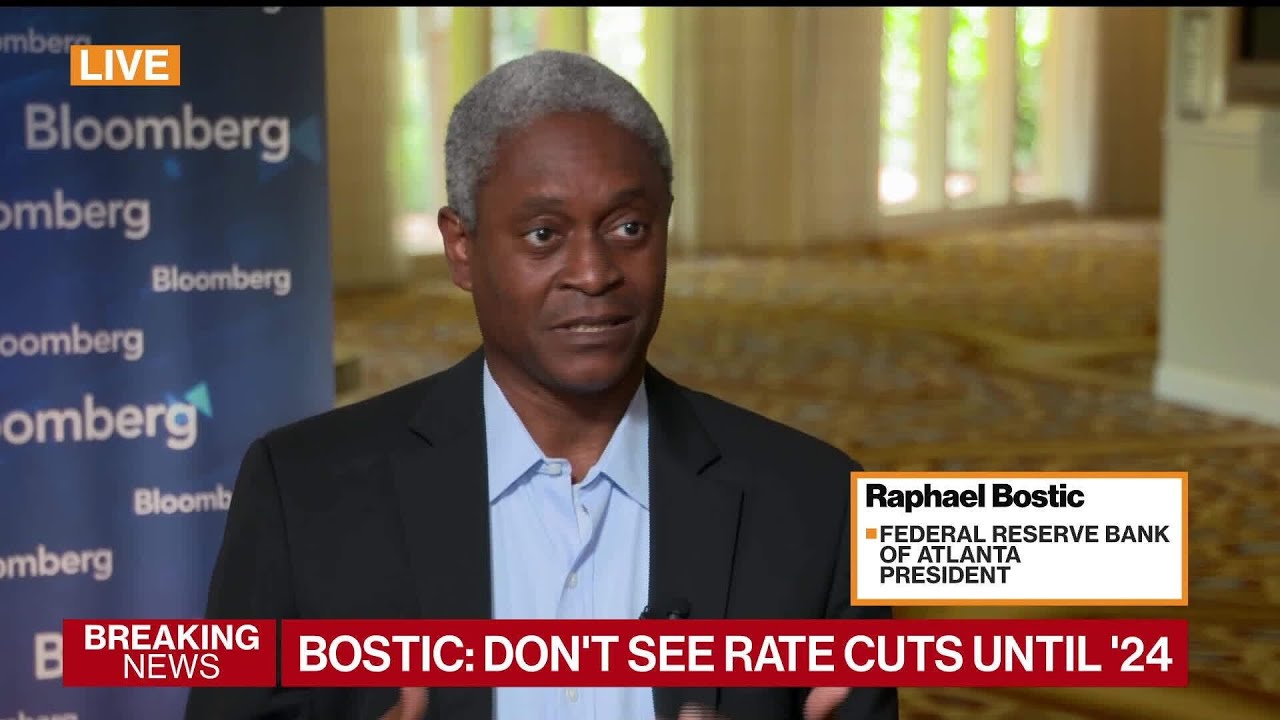

Fed's Bostic On Inflation Fight, Labor Market And Banks

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

Ladies and gentlemen, fasten your seatbelts and get ready to dive into the intriguing world of economics, where inflation has been the star of the show lately. CPI and core CPI have certainly been causing quite a buzz. They soared to new heights, but now they seem to have hit a plateau. But hold your horses, folks! The Atlanta Fed has something up its sleeve—an inflation dashboard showcasing a slew of other inflation measures, and many of them are painting a bleaker picture than they were a year ago. So, has the Fed really done enough to tame this unruly beast we call inflation?

Well, first off, I want to express my gratitude for having you fine folks from Bloomberg at our conference. Your team is like the secret sauce that spices up the economic discussion. Now, let's get down to brass tacks. When I look at the inflation trajectory, I see some pretty positive developments. Think about where the economy and inflation were last summer compared to today. We've witnessed significant improvements. No more of those dreaded nine or ten percent levels; we're now cruising at around four and a half to five percent. Sure, that's still twice our target, but it's progress, my friends. We've seen some of the froth come out of the inflation measure.

You know what I keep my eagle eye on? The number of goods in the CPI basket showing inflation above five percent. In the latest report, it's less than half. At one point, it was a whopping 70 or 80 percent! That narrowing breadth is like music to our ears—a harmonious sign, if you will. So, yes, I do believe our policies are starting to show their magic. But hey, don't think I'm ruling out any more rate increases. In this economic circus of uncertainty, we can't rule anything out. We've been in restrictive territory for half a year or so, and that's about when our policies start tightening their grip on the economy. Businesses are starting to feel it, which is a positive sign. Yet, we've had more surprises than a magic show in recent years, and most of them were on the wrong side when it came to reaching our inflation target. So, it's on the table, my friends.

The June Meeting Dilemma

But wait, we're not done here! We've got two more inflation readings and a jobs report before our next meeting in June. So, what's on my mind for that meeting? If I had to cast my vote right now, I'd probably opt to hold steady. There's a treasure trove of data we're yet to unearth, and I'm all about making informed decisions. The businesses I'm chatting up across the sixth district and the survey responses all seem to paint a picture of an impending slowdown. That's a comforting thought because it allows us to see how the current restrictive policy plays out before we make our next move.

The Business Whisperer: What Are They Saying?

Now, let's put on our Sherlock Holmes hats and deduce what businesses are whispering in our ears. Pricing power, ah, that's an interesting one. During most of the pandemic, businesses told us they could raise prices if their input costs climbed, and consumers would nod along. But here's the twist in the tale—consumers have become price-sensitive. Businesses are finding it tough to continue raising prices, and their ability to pass on those higher costs is dwindling. It's a beautiful thing, really. It means we might be edging closer to an economy in balance, which could be our ticket to that elusive two percent target.

The Great Labor Conundrum

But what about the workforce, you ask? Well, buckle up, because the labor market has its own plot twist. Businesses are telling me that hiring and internal turnover have improved compared to the pandemic's darkest days. But hold on to your hats; we're not out of the woods yet. We've had a pandemic that left families pondering their work-life balance, employees questioning their place in the job market, and a surge in retirements. That's a recipe for some historic unemployment rates. So, while businesses may be thinking twice about letting go of their best folks, let's not jump the gun and declare that the old labor market rules have flown out the window. We need time to understand the structural changes triggered by the pandemic.

The Banking Tightrope

And now, for a question that could make anyone's head spin—banks and credit standards. When the Fed raises interest rates, credit standards tighten, and loan demand wanes. It's like a dance we've seen before, but the question is, will this time be different? Bankers tell me they're more conservative due to the rise in liquidity risk, but we're not in a credit crunch scenario just yet. It's a balancing act, my friends.

Looking to the Future

Let's round things off with a curveball—central bank digital currency in Florida. Now, I haven't had any chats about this, but here's the scoop. The Fed has been mulling over this concept, but it's not an imminent move. As for Florida, well, they might have some insider knowledge, but I'm not in the loop on this one.

In conclusion, the inflation tango is still underway, and the dance floor is full of surprises. We're making progress, but there's no telling when the music will stop. So, keep your eyes peeled, and let's see where this economic extravaganza takes us. Remember, in the world of economics, every twist and turn is part of the show, and we're here to enjoy the spectacle.

Related Recaps

- An EASTER EGG from ALL BLACK OPS ZOMBIES! [SPEEDRUN!!]⭐[Call of Duty: Black Ops 1/2/3/4 ZOMBIES]

- JUST IN: Republican Senators Blasts Biden Over The Border As Title 42 Ends

- APEX SAISON 17 : LEAKS Ranked et Maitrise d'Armes et REVUE des SKINS POURRIS VEILED

- GEOFF KILLED E3

- LARI DIZ Q Ñ AGUENTA O SOFRIMENTO DE FRED E VAI INVADIR...