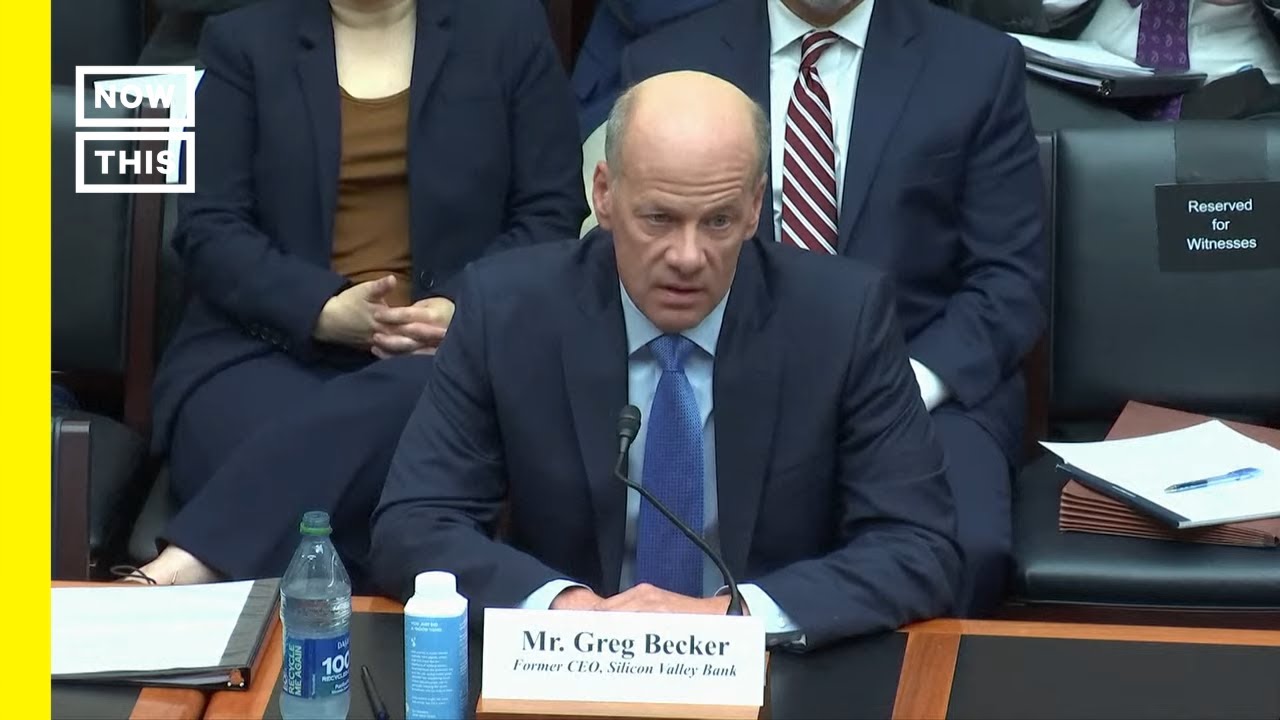

Svb, Signature Bank, First Republic Bank Execs Testify Before House Committee

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

In the ever-evolving landscape of finance and banking, the concept of perplexity takes center stage. "Perplexity" measures the complexity of the financial text, and it's a concept that often leaves us scratching our heads. It's the enigmatic nature of the financial world that keeps us on our toes, trying to decipher its intricate codes. But this perplexity is what makes the financial world so intriguing.

Burstiness: Riding the Rollercoaster

Now, let's talk about "burstiness." This concept is like riding a rollercoaster in the world of finance. It's the thrill of the unexpected, the sudden highs and lows that keep us engaged. Humans tend to inject burstiness into their financial strategies. We mix in long, complex sentences with shorter, more direct ones, creating a rhythm that keeps us captivated. AI, on the other hand, tends to be more uniform and predictable. But we're not here to be predictable, are we?

Predictability: Breaking the Mold

Predictability is the third player in this financial game. It's like trying to guess the next move of a chess grandmaster. Humans revel in defying predictability. We craft our strategies to keep our opponents guessing. It's the art of surprise, the thrill of staying one step ahead. But in the world of AI, predictability often reigns supreme.

In the financial world, we all aim to make choices that stand the test of time. Hindsight is 20/20, and in retrospect, we would have undoubtedly made different choices. In a dynamic world where high inflation looms as a lurking threat, our strategies must adapt and evolve. We must navigate the uncertainties with flair and finesse.

The speaker in this enigmatic tale mentions the need to manage their balance sheet differently if they had anticipated the rapid rise in interest rates. The plan presented by Signature Bank assumed selling the entire available portfolio, even if it meant taking losses. The events of March 10th threw a curveball, and opening the discount window earlier might have changed the game, or so they wonder. Their primary goal was always to serve clients, support non-profits, and assist small businesses, even though they carried a concentrated level of risk.

The termination of the Chief Risk Officer raises questions about regulators and their awareness of the situation. Did they know about the delay in disclosing the information to shareholders? It's a mystery that unfolds as the story goes on.

Holding the Titans Accountable

The financial world isn't all perplexity, burstiness, and unpredictability. It's also about accountability. We must hold the titans of finance responsible for their actions. The decisions made by these executives affect not only their customers but our entire banking system.

Mr. Becker, your bank experienced rapid growth in size, but the FED had been citing poor risk management, including interest rate risk, as early as 2018. It's hard to believe you weren't aware of the looming storm. The selling of shares before the bank's downturn raises eyebrows. It's a piece of the puzzle that doesn't quite fit.

The Unraveling Drama

The drama unfolds further as we delve into the decisions made over a crucial weekend. The DFS evaluated the conditions of the firms, seeking to preserve the safety and stability of the banking system. Three options loomed: finding a way for Signature to open safely, finding a buyer, or the DFS taking possession and naming the FDIC as the receiver. The decision was driven by the inability of Signature to provide reliable data and a credible liquidity strategy.

The complexity of the financial world is further underscored as we venture into the speaker's insights. They joined the council in 2023 and highlighted the concrete concern of interest rate risk in our current financial system. The run on Silicon Valley Bank involved a multitude of factors, including social media and emergency filings. But pinpointing the primary catalyst remains elusive.

The migration of deposits from smaller community banks to larger institutions becomes a cause for concern. Diversity in the banking system is vital, and we must navigate the treacherous waters of crypto assets and stable coins with caution. The need for robust risk management protocols is paramount.

The financial world is a labyrinth of perplexity, burstiness, and unpredictability, but it's also a realm of accountability and responsibility. We must scrutinize the actions of those who hold the keys to our financial stability.

As we peel back the layers of this financial enigma, we realize that there's more to the story than meets the eye. The world of finance and banking is a symphony of complexity, unpredictability, and responsibility, and it's up to us to decipher its melodies.

Related Recaps

- Trey Lance News, NFL News, Signings, Rumors & NFL Draft Stuff | Wednesday April 19

- Jiro’s DAY-OUT on a Summer Monsoon

- Could a potential Jadon Sancho loan move from Man United to Borussia Dortmund work for all parties?

- How To Deliver Photos To Clients Like A Pro!

- 257 Pavel Yosifovich, Author of Windows Kernel Programming: Second Edition