Svb's Collapse Shocked Markets And Caused Them To Overshoot, Says Pgim's Daleep Singh

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

In today's fast-paced and ever-changing world, it's essential to stay on top of the latest news and trends. And when it comes to the economy, it seems like everyone has an opinion. But what happens when the data doesn't match up with the expectations? That's precisely the situation we find ourselves in now.

A Game Changer in the Making

Steve, our Chief Global Economist, laid out an interesting case regarding the economy's current state. He pointed out that the job market might be cooling faster than the original data suggested. But is there anything in the markets right now that is painting a different picture? Is there a disconnect between what the economic data suggests and what the expectations are?

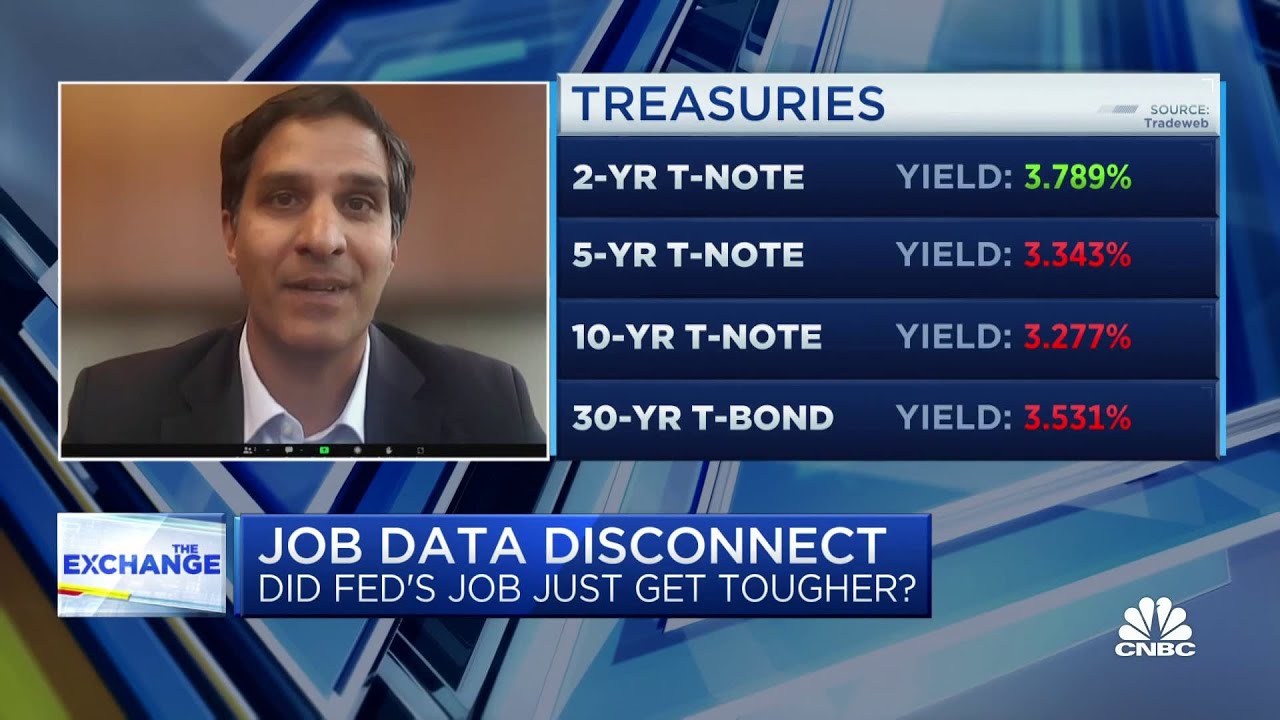

Well, my friends, it's a game changer, to be sure. While interest rates may not have been dramatically affected, there's more to the story. The flight to safety and recent weak economic data have so depressed yields that this new news, which I believe is a game changer, might not look like it. But trust me, it really is a game changer.

Let's dive into the real numbers, shall we? Look at the continuing claims. We haven't seen 1,713,000 in four weeks. And not many have been over 1.7 million, as you can see. But recently, we've had one, two, three, four, five in a row above 1.8 million. That's quite a shift. And if we consider the psychological level of 200,000 for continuing claims, we had only one in the last four weeks. You have to go back another nine weeks to find a similar pattern. Now, take a look at this. We've had nine in a row above that psychological threshold of 200,000. It's a big deal, my friends.

The Importance of Data Trust

Why is any of this important, you ask? Well, let me tell you. We have a three-day weekend in the U.S. with the holiday tomorrow. And in Europe, they have a four-day weekend with their holidays. And guess what? All of this is happening when we release potentially the biggest number ever tomorrow. Jobs, my friends, after all these revisions going back to 2020, anything could happen here. We have recalibrated on the fly, and it really just puts in bold letters—I don't trust the data.

The Market Already Knows

Rick, my good friend, made an excellent point earlier. The market is already there. It already has this weakness built-in. And when you look at the Fed funds outlook in January 2024—oh boy, Rick gets me excited. But here's the thing, my friends. Take a look at what's happened to the yields. The market says we're going to have this weakness. It didn't know about the proof, but it felt it. So if you're thinking there's going to be a bounce back after the flight to safety, think again.

The markets are sorting it out, my friends. And what a time to be alive when you're the head of fixed income and dealing with these types of markets. It's got to be a time when you're maybe a little confused. But fear not, for there's always something to take away from this mishmash of economic data.

The Time for a Pause

Now, let's talk about risk management principles. They tell us that if you're the Fed, it's time to pause. Another 25 basis points might produce small, incremental gains in terms of cooling inflation. But at this point, the risk is so much larger, my friends. It's a nonlinear amount of pain. We're seeing more evidence of an inflection point in the labor market with the data. If we want to land this economy softly, we can't solely depend on the spot data. We have to be forward-looking, my friends. We have to look past the lagging indicators like inflation, which will probably look sticky next week. Instead, we need to focus on the rate of change and the leading indicators to the labor market. That's where the real judgment lies.

Overshooting and the Path Forward

Now, let's talk about shocks. When we get a shock, markets tend to overshoot. Initially, after the news, we saw rates markets overreact to some extent. But now that we have a better understanding of the situation, we can start to see a clearer path forward.

So, my friends, what does this all mean? It means that we're in for an exciting ride. The economy is a complex beast, and sometimes the data doesn't align with our expectations. But that's what makes it all so fascinating. We have to stay nimble, adapt to new information, and remember that the market is always one step ahead. So buckle up and get ready for whatever comes our way, because the world of finance and economics is anything but dull.

Related Recaps

- На Київщині біля приватного будинку стався смертельний вибух

- ORAÇÃO DA NOITE NO SALMO 23 PARA O JUSTO JUÍZ - DIA 7 | CAUSAS IMPOSSÍVEIS

- H2H Categories Mock Draft Recap! Drafting from the First Overall Pick | Fantasy Baseball Advice

- Bocal de Ouro 2023 - Etapa Morfológica - Machos - 04/05/2023

- Rules of the Road: Driving In Construction Zones