Reserve Bank Of Australia Raises Rates: Signs Of Global Recession

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

Stock futures are showing little change after a quiet day in the markets. However, the calm may not continue as central banks around the world gear up for action. The Federal Reserve (FED) is beginning their meeting today, joined by a few other central banks. Jeff Klein top, Chief Global Investment Strategist at Charles Schwab, provides insights on what we can expect from these central banks.

Surprise Hike by the RBAThe Reserve Bank of Australia (RBA) surprised the market with a hike this morning, making them one among many major central banks that are not yet done with their monetary policies. Earlier this year, we saw Norway also stop and start again. Looking ahead, the FED is set to announce their decision tomorrow, followed by the Bank of England next week. Both banks are likely to make a 25 basis points move. Additionally, the European Central Bank (ECB) will reveal their plans later this week. Despite concerns about the state of the global economy, interest rate hikes are not over yet.

Section 2: Sentiment and Implications

A Sentiment Perspective on the Australian HikeWhile the RBA's surprise hike may seem far away from home, it holds significance from a sentiment perspective, especially as the dollar strengthens. Even when another central bank unexpectedly adopts a hawkish approach, it raises questions about whether or not the FED has a surprise of its own up its sleeve. The market is anticipating a more hawkish tone from the FED, with a 25 basis points increase being the consensus. However, there is a possibility that Chairman Powell's message will be even more hawkish, leading to potential market volatility.

Economic Data: Services and ManufacturingThe global economy seems to be heading in two different directions. Services continue to boom, while manufacturing is in a recessionary state. This trend is not unique to Europe, but can also be observed in the United States and China. The manufacturing recession is evident when examining indicators such as production, trade, and demand for corrugated liner board. On the other hand, services such as airlines and restaurants are thriving. This dichotomy is contributing to flatline GDP growth.

China's Impact on Global GrowthChina, often hailed as a driving force in global growth, is currently experiencing an exceptional economic recovery. Economic data from official sources as well as alternative measures, such as air pollution tests and crude oil imports, suggest a strong economic backdrop. Positive surprises in the data are reminiscent of the so-called "brick era" when Brazil, Russia, India, and China fueled global growth. China's economic strength is currently playing a significant role in global inflation revival.

Section 3: Inflation, Stocks, and Geopolitics

The Potential Cure of China's StrengthWhile some product categories are experiencing inflation due to increased consumer spending and demand for services, there has not been a significant impact on general product prices or raw materials. Housing is slowly recovering in China, but there hasn't been a significant uptick in commodity-driven inflation. Despite retailers and manufacturers reporting reduced inventories due to Chinese demand, they have not expressed confidence in stabilizing prices. It remains to be seen if sustained economic growth in China will eventually lead to increased inflation.

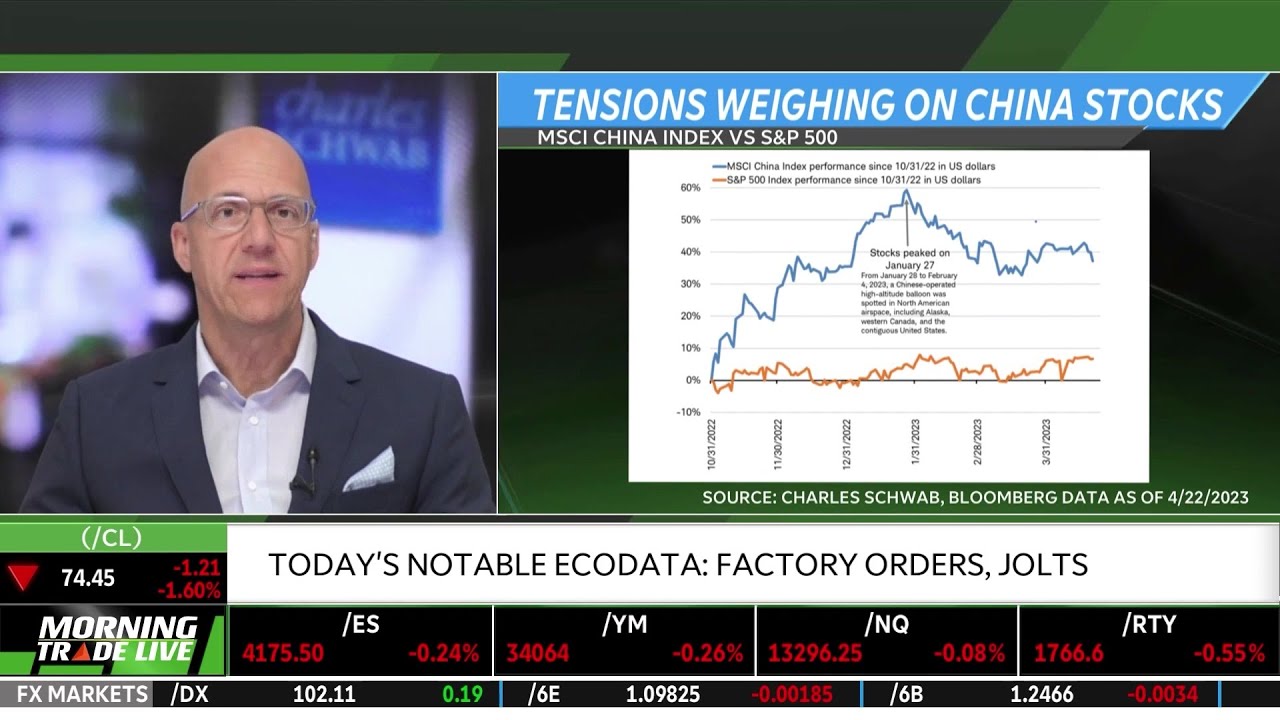

International Stocks as the BaselineLooking at the stock market, Jeff Klein top still favors international stocks over US stocks, with a focus on developed markets, particularly Europe. However, the performance of emerging markets, including China, is heavily reliant on China's economic momentum. While China's stocks initially rallied on reopening optimism, concerns over geopolitics have weighed them down. The potential unveiling of an executive order targeting investment in China could further escalate tensions and impact stocks. Although there may be some dialogue between the two sides, a resolution is not expected in the near term.

In conclusion, central banks are far from finished with their policies, and the market remains uncertain about the FED's decision. The contrasting performance of services and manufacturing is contributing to flatline GDP growth. China's economic recovery continues to surprise, with the potential to ignite global inflation. International stocks remain a favorable choice, but tensions and geopolitical factors may impact stock performance in the near term. As the markets continue to navigate these uncertainties, investors should brace themselves for a wild ride.

Related Recaps

- Remus's Rules - 752 and 753 - Trees

- If you're having a bad day, these videos will cheer you up | Best Clips Of YouTube

- Susie Hansen - Frank Sinatra (Cha Cha Cha)

- [ES] DPC 2023 SA Spring Tour División I - Bo3 - Infinity vs Alliance.Latam

- Patel it like it is: The importance of safe drinking water | ABCNL