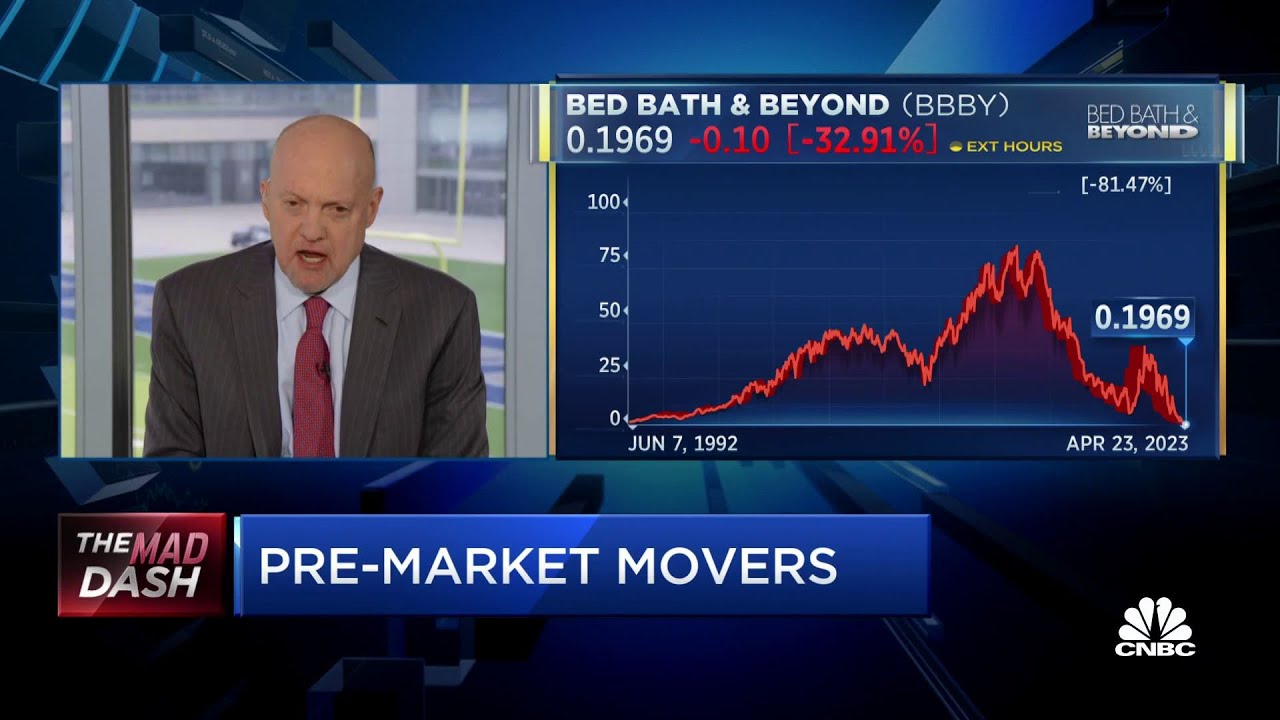

Cramer's Mad Dash: Bed Bath & Beyond Was One Of The Worst-Run Companies I'Ve Ever Seen

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

In the fast-paced world of finance, where every second counts, the opening bell rings, signaling the start of another week in the bustling metropolis of New York. As the markets come alive, the spotlight falls on Bed Bath & Beyond, a company that has been attracting attention for quite some time. With its history of stock buybacks and precarious financial situation, the stage is set for a captivating story of turbulence and reinvention.

Bursting at the Seams: Stock Buybacks and Financial Precarity

Bed Bath & Beyond, once hailed as a potential takeover target, embarked on an aggressive stock buyback spree. However, their relentless pursuit of repurchasing shares turned into a double-edged sword. The company's financial health began to show signs of strain, causing alarm bells to ring among industry observers, including the astute Jim Cramer.

Cramer, known for his insightful commentary, had long warned about the precarious nature of Bed Bath & Beyond's financial situation. His concerns were not unfounded, as the company faced mounting challenges in generating revenue. Despite still earning $6 billion, Bed Bath & Beyond found themselves in a vulnerable position.

The Reits: A Silver Lining Amidst the Chaos

Amidst the turmoil, there emerged a glimmer of hope for Bed Bath & Beyond. The company owned prime real estate situated adjacent to eight different Real Estate Investment Trusts (REITs). Surprisingly, these REITs experienced a surge in demand for such spaces, given the relatively low number of companies exiting the market. This positive turn of events offered some respite for both the REITs and their neighbor, Target.

While Bed Bath & Beyond's fate hung in the balance, the REITs were presented with a unique opportunity to attract new tenants and raise rents. These unexpected developments were a testament to the resilience of the retail sector. Despite the challenges faced by companies like Party City and David's Bridal, the overall strength of the market, coupled with the Federal Reserve's actions, helped keep the industry afloat.

The Ill-Fated Attempt at Reinvention

Desperate to stay afloat in the face of mounting competition, Bed Bath & Beyond made an ill-fated attempt at reinvention. Mark Tritton, formerly from Target, entered the picture, aiming to revitalize the stores. However, Tritton's efforts were met with mixed reactions from disgruntled customers.

While some applauded Tritton's ambition, many believed that Amazon's dominance in the market was insurmountable. Bed Bath & Beyond's reliance on private-label products, predominantly sourced from China, proved to be a fatal flaw. The reinvention fell short, leaving the company without the necessary inventory to entice customers. Coupons came and went, but the damage had already been done.

The Great Exodus: Opportunities for REITs

As Bed Bath & Beyond prepares to abandon its spaces, a silver lining emerges for the REITs that own the properties. Multiple bidders have expressed interest in occupying these prime locations, presenting an opportunity to substantially increase rents. Despite the challenges faced by the retail industry, strip malls across the country continue to thrive.

Brian Cornell, the CEO of Target, shares in the anticipation surrounding the availability of prime real estate. In a climate where companies like Party City, David's Bridal, and Bed Bath & Beyond have struggled, the willingness of many businesses to invest in coveted locations speaks volumes about the strength of the retail landscape.

The Tapestry of Bed Bath & Beyond: Triumphs and Tribulations

The Bed Bath & Beyond saga is a story woven with intrigue, exemplifying the highs and lows of the retail industry. From the ambitious stock buybacks that fueled financial precarity to the ill-fated attempt at reinvention, the company's journey is a cautionary tale. However, amidst the chaos, there are glimmers of hope, with REITs poised to benefit from the vacuum created by Bed Bath & Beyond's departure.

As the markets continue to fluctuate and the tides of fortune shift, one thing remains clear: the world of retail is ever-evolving, offering both challenges and opportunities for those brave enough to navigate its unpredictable waters.

Related Recaps

- شفا اشتغلت مسحراتي رمضان أول مرة !

- Top 10 Craziest Fans in Football

- Bored out of your mind at work? Your brain is trying to tell you something. | Dan Cable | Big Think

- El 25 de junio se elegirá nuevo gobernador en Córdoba: qué más se vota

- Donald Trump's Mar-a-Lago speech following his arraignment in hush money payments case | WION