The "Just One More" Paradox

Unleash Your Creative Genius with MuseMind: Your AI-Powered Content Creation Copilot. Try now! 🚀

Betting on Heads or Tails: The Non-Ergodic Twist

Today, we embark on a game that initially seems straightforward but unravels a remarkably counterintuitive mathematical principle. Picture this: you start with a crisp $100 bill and engage in a series of coin flips. Every time you land heads, your wallet swells by a whopping 80%. Conversely, every tails result slashes it by half. The dance goes on. For instance, heads double your $100 to $180, then another heads takes it to $324. A tails brings you down to $162, and so on. On the surface, it sounds like a sweet deal, right? Who wouldn't want to play?

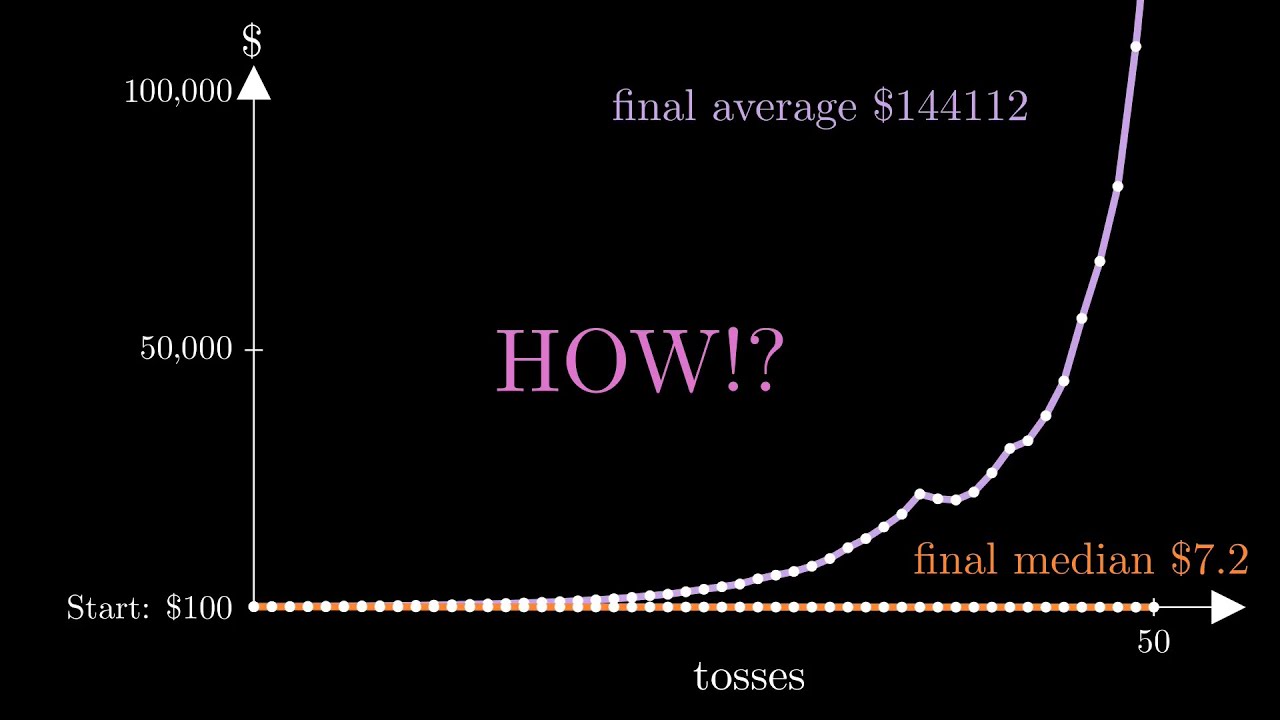

Now, let's throw a curveball. Let's simulate a million individuals, all commencing with $100 and engaging in 50 rounds. Here's the kicker: their average wealth skyrockets exponentially, but their median and mode nosedive to a measly $7.2. Why, you ask? Enter the non-ergodic system, where the population's average doesn't align with the individual outcomes. But why does the median plummet so low?

A Visual Voyage: Navigating the Paradox

Let's visualize the conundrum. We start at $100, and with each flip, we either multiply by 1.8 (heads) or 0.5 (tails). Even a single occurrence of both heads and tails sees our fortune plummet to $90. The average is boosted by the fortunate outliers, but the mode—the most frequent outcome—trends downwards. This is the essence of the "Just One More Paradox." Each individual flip seems auspicious, but the collective result isn't. This paradox resonates in realms from gambling to personal relationships to life-altering decisions.

The crux of this paradox lies in the game's multiplicative nature. Every flip multiplies our entire fortune by a certain factor. As we descend the wealth ladder, the potential for gains dwindles.

An Additive Twist: Changing the Game

What if, instead of betting our entire wealth, we wager a fixed sum of $50 on each coin flip? This introduces an additive approach to the game. We're no longer navigating in logarithmic territory; we've merely shifted our strategy. Heads now yields $40, and tails costs us $25, regardless of our current wealth. Lo and behold, our mode now ascends, aligning seamlessly with the average. A winning strategy, right?

The Art of Fractional Betting: Unveiling the Kelly Criterion

But hold your bets! What if we always wagered a fraction of our wealth, say 1/5 or 1/10? Heads would multiply our wealth by 1.8 times the fraction, and tails by 0.5 times the fraction. After a series of flips, we're left with an expression that unveils the expected mode growth rate per flip—a geometric mean.

However, the question arises: is betting 1/10 of our wealth the optimal strategy? Why not 1/15 or 1/5? Enter calculus to the rescue. By generalizing our equation and graphing it, we unearth the fraction of wealth (0.375, to be precise) that maximizes the growth rate. At this magical fraction, the mode growth rate leaps to 1.028 per coin flip.

Conclusion: The Kelly Criterion, a Paradox Unraveled

In this fascinating journey, we've unearthed the enigmatic Kelly Criterion, a gem of probability theory. Pioneered by John Larry Kelly Jr. in 1956, this criterion provides a compass for investors, guiding them on what fraction of wealth to bet to optimize their growth rate.

Congratulations! You've navigated through a whirlwind of probability and emerged with a fresh perspective on an age-old paradox. Kudos to you!